IN THIS ARTICLE

MCLR revised rates w.e.f. (Henceforth, MCLR will be published on 15 th day of respective month). Aggregate value of deposits placed by a depositor on the day for an identical tenor will be taken for deciding applicable interest rate. For interest rates for deposits of Rs. 2 Crores and above, Please contact our nearest branch. Interest is calculated on daily product basis and is credited on quarterly basis in the months of April, July. Andhra Bank savings account comes with interest rates of up to 4%, depending on the daily balance, and the type of account. Do keep in mind that the rates are subject to change at the sole discretion of the bank. Andhra Bank Savings Account Charges Different Andhra Bank savings accounts have a different schedule of charges. Andhra Bank FCNR FD Interest Rates (as on 26 Feb 2021). The FCNR FD interest rates on currency like USD, GBP, EUR,AUD, CAD, YEN. FCNR Fixed deposit depends on term deposit for example 1 year, 2 years or upto 5 years you deposit your money and your choice between different banks.

- Andhra Bank Deposits Schemes

Andhra Bank provides its customers a variety of deposit schemes to their Andhra Bank Account holders. The rate of interest for the different deposit schemes varies depending upon the period of deposits, already prevailing rates of interest and the rules set by government. Senior citizens have an extra benefit of 0.05% interest for the recurring deposits.

Andhra Bank Types of Deposits

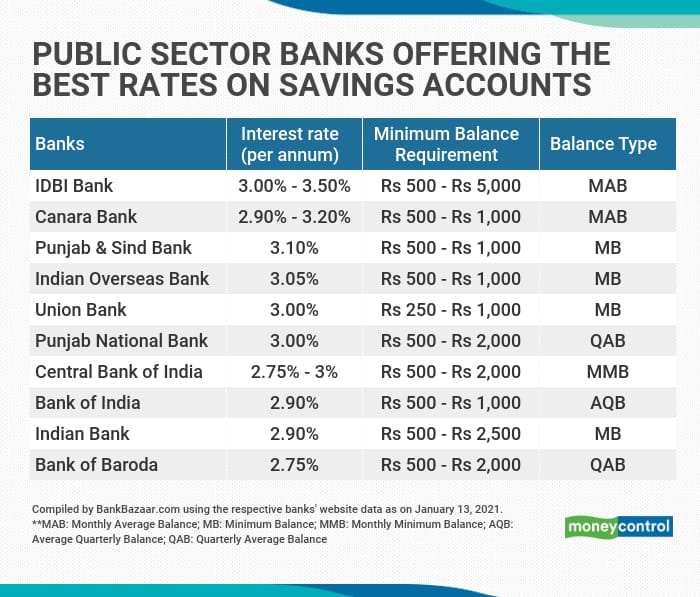

What Is Best Savings Account Interest Rate

The variety of deposit schemes offered by the bank are, AB Shubh Yatra (Holiday Saving Account), AB Recurring Plus, AB Freedom (Flexi) deposit scheme, AB Tax Saver, AB Fixed deposits, AB Kalpataruvu deposits, AB Recurring deposits, and AB Smart Choice.Other Banks like IndusInd Bank Deposits and Union Bank Of India Depositsalso providing different type of Deposits same as the Andhra Bank.

You Can Also Check Here For Better Banking Experience

Andhra Bank Deposits Interest Rates

Andhra Bank Savings Account Interest Rate Per Month

There is a much difference in between one scheme to another scheme. Andhra Bank Interest Rates are vary from one scheme to another scheme. For AB Recurring Plus, it is as per term deposit rates, for AB Freedom (Flexi) deposit scheme, it is at local term deposit rates for units converted to term deposits, for AB Money Time it varies from 4 to 6.5% for deposit below 1.00 crore and 4 to 5.75% for above 1.00 crore and below 10.00 crores and the maturity period varies from 7 days to 10 years, for AB Tax Saver it is 7.75% and the maturity period is 5 years, for AB Kalpataruvu deposits it is same as AB Money Time, for AB Recurring deposits it depends on various inputs such as the maturity period or deposit period and the amount accumulated in the account at the time of applying interest rates on a quarterly basis, and for AB Smart Choice, it is 4%, 4%, 4.25%, and 5% for deposited amount from 1.00 Crore to 10.00 Crore, for maturity periods of 7 days to 14 days, 15 days to 45 days, 46 days to 90 days, and 91 days to 179 days respectively. HDFC Bank Deposits, South Indian Bank Deposits and Allahabad Bank Deposits are also providing different deposit schemes depends on the period of deposit.

You Can Also Check Andhra Bank Cards

Andhra Bank Deposits Schemes

The variety of deposit schemes offered by the bank are explained as follows.

AB Shubh Yatra (Holiday Saving Account) which is a scheme planned by Andhra Bank in collaboration with M/s Thomas Cook India to present a savings plan for your holidays.

AB Recurring Plus is to accumulate the savings of the depositors over a period to meet future emergencies.

AB Freedom (Flexi) deposit scheme which is term deposit and savings accounts combined to provide better benefits to customers who wish to save the invested money for longer periods.

AB Recurring deposits and AB Smart Choiceis a type of fixed deposit with higher deposit amount requirement of 1 crore or higher and the term of the deposit is only 179 days.

AB Money Time is a monthly income deposit scheme that forms an aggregate amount to provide the customer with regular income.

AB Tax Saver is a scheme planned for customers to avail tax benefits under the notifications of the union government.similar to Andhra Bank,United Bank of India Deposit Schemes also provides the different schemes to their customers

AB Fixed deposits is scheme provided by the bank to enable investors to get higher rate of interest on their savings compared to a regular savings account.

AB Kalpataruvu deposits is a cumulative term deposit which has a minimum deposit amount set. For more details you can also check here for other Banksrelated information.

FAQ’s Related to Andhra Bank Deposits

- What is the minimum and maximum period of the Deposit?The minimum and maximum periods of deposits are 7 days and 179 days respectively.

- Is the Rate of Interest fixed for all the Schemes?No, the rate of interest varies from time to time and is decided by the headquarters.